Case Studies

Unauthorized Occupant Removal & Rapid Estate Sale

Snapshot

We coordinated removal of an unauthorized occupant with the Sheriff, secured and cleared the property within 24 hours, installed on-site security, and closed an as-is estate sale more than 14 percent above appraised value within days of court approval.

Sale Price: $720,000

Over 14% above appraised value

Closed within 5 days of court approval

The Challenge

A fiduciary company was responsible for liquidating an estate-owned property occupied by an unauthorized individual. The property presented immediate risk due to unlawful occupancy, lack of security, and potential liability exposure for the estate.

How We Helped

1. Coordinated Lawful Occupant Removal

We met on site with the Sheriff to assist with the lawful removal of the unauthorized occupant and ensure the process was handled properly, safely, and with full documentation for the fiduciary record.

2. Immediate Securing & Property Control

Within 24 hours of occupant removal, we boarded and secured the property, preventing re-entry. We also coordinated the installation of security cameras to ensure the home remained protected throughout the sale process.

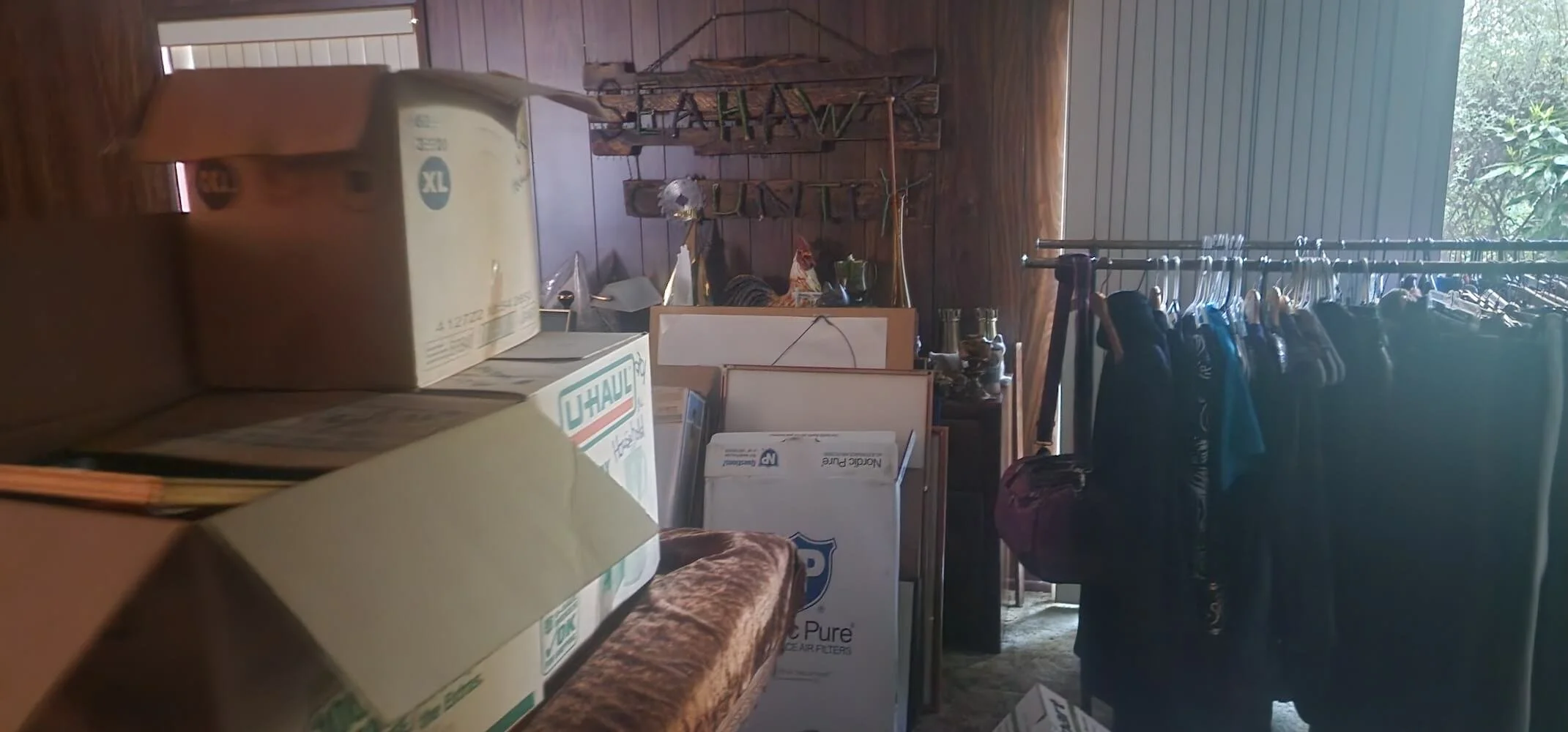

3. Rapid Content Removal & As-Is Preparation

We coordinated and executed a full interior content removal of the home within 24 hours of vacancy, allowing the property to be positioned for an immediate as-is sale without delay or additional liability.

4. As-Is Sale Above Appraised Value

The property was sold as-is for $720,000, more than 14% above appraised value. The transaction closed within five days of court approval, delivering a clean, documented outcome for the fiduciary and the estate.

View Property Images

Foreclosure Halted & State Lien Eliminated

Snapshot

We eliminated a six figure state lien, cleared a drug infested property of squatters with law enforcement coordination, extended an active foreclosure auction, and closed a court-approved sale within days, allowing the attorney’s legal fees to be paid at closing.

$400,000+ DSHS lien reduced to $0

Closed within 3 days of court approval

Attorney Fees: $10,000 paid at closing

The Challenge

An attorney client was responsible for resolving a severely distressed Auburn property encumbered by more than $400,000 in Department of Social and Health Services (DSHS) liens. The home was actively facing foreclosure, overrun by squatters, and being used for drug activity, creating extreme legal, financial, and safety exposure.

How We Helped

1. Negotiated Full State Lien Release

We worked directly with DSHS and successfully negotiated a complete release of the lien, reducing a $400,000+ obligation to zero and clearing the title so the sale could proceed.

2. Squatter & Drug Activity Removal

We initially negotiated with occupants to vacate the property peacefully. When conditions escalated, we coordinated with local authorities, including SWAT, to safely remove squatters and drug users from the home, ensuring the property could be secured without further incident.

3. Foreclosure Auction Extension

RREG worked directly with the lender to extend the foreclosure auction date, creating the necessary window to complete a court approved sale rather than losing the property at auction.

4. Rapid Court-Approved Closing

Following court approval, we closed the sale within three days. The transaction resolved the foreclosure, cleared title issues, and ensured the attorney client received $10,000 at closing to cover outstanding legal fees.

View Property Images