Short sale options in Seattle

The Bank may pay you CASH as part of the Short Sale!

Not only do some banks allow homeowners to preserve their credit score by working with them to sell their property, they are also allowing them to benefit from a short sale financially.

Most banks are offering relocation assistance to homeowners that participate in a short sale. In some cases, as much as $30,000.00. A bank that considers a short sale would typically dictate that the owner only gets to walk away from the house.

However, some banks now see the financial benefits of working with a homeowner that is motivated to sell the property. A motivated homeowner can help the bank solicit a buyer that pays top dollar for the home by keeping the property clean and maintaining the landscaping during the selling process.

Once a bank forecloses on a home, the bank has to clean, maintain, get the property market ready and find a buyer. This could lead to a significant financial loss for the bank. The resale value could be thousands less by then, compared to working with the struggling homeowners to sell the property.

Seattle short sale real estate agent

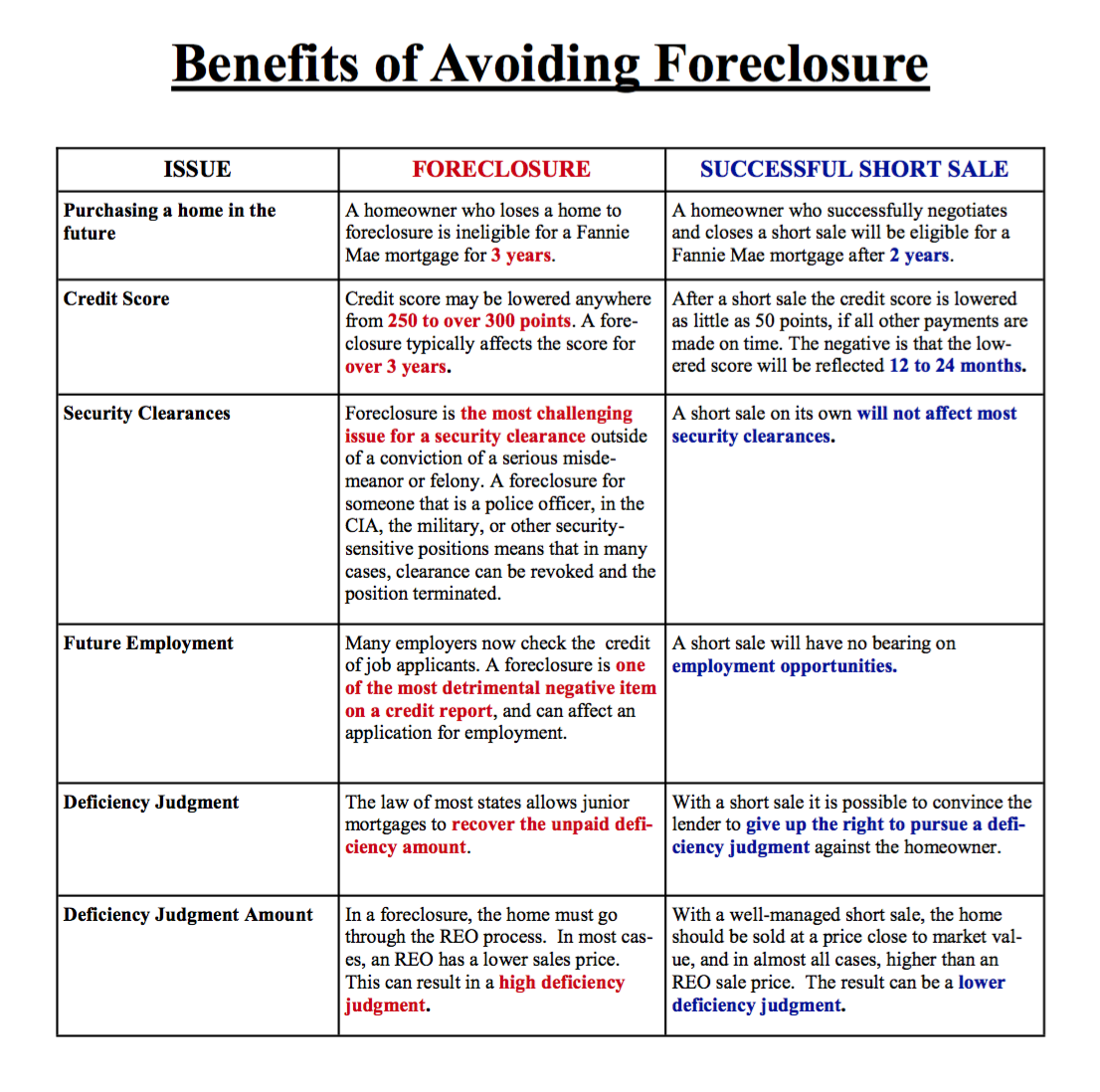

A short sale will allow you to avoid foreclosure by selling your property.

If you owe more than what the value of the house might be worth, you can still sell for an amount less than what is necessary to pay off your mortgage in full and not be required to pay the remaining balance. It is more convenient and cost effective for your lender to consider working with you than it is to the sell the property after foreclosure.

As part of the vast array of services offered by The Russell Real Estate Group, our lead Realtor Kirk Russell is a prominent short sale expert Realtor who has helped dozens of homeowners overcome this hardship.

Why work with us?

If you are a homeowner who is considering a short sale, we can do more for you than just sell your home. In today’s housing market, a good real estate agent is knowledgeable on different marketing methods, is up to date with their market knowledge, and has a solid network of reputable partners.

With over a dozen years of experience in the Puget Sound housing market, Kirk and his team of dedicated Realtors, are ready to help you sell your home so that you can move onto the next chapter of your life.

Avoid the negative stigma of foreclosure that can haunt you for years to come. If your home goes into foreclosure, you may not be able to purchase another home for seven years. If you make a short sale, that period is divided in half.

The choice is yours.

Benefits of a short sale

When you are at risk of foreclosure, a short sale is a viable option.

The benefits of a short sale include:

Lesser effect on your FICO credit score than with a foreclosure. A foreclosure can drop your credit score by as much as 400 points. Although each lender reports a short sale differently to the credit bureau, the effect on your credit will be that of a mortgage paid in full. Only the late payments before the short sale will affect your overall credit score.

You will have no mortgage payments to make unless you choose to keep making them.

You retain dignity in knowing that you sold your home as opposed to losing it to foreclosure; you avoid the stigma of foreclosure.

Under Fannie Mae Guidelines, you can buy another home in as little as two years. If you have no sixty-day-plus late payments, you may be eligible to purchase another home immediately.

Every day that you don`t do anything is another day that you move closer and closer to foreclosure.

Home Affordable Foreclosure Alternatives Program (HAFA)

Working with your bank to see if you qualify for a HAFA short sale can be very simple if you ask the right questions and are able to provide the appropriate documents. There are no costs for you to work with a professional like myself. You don’t have to do this on your own!

In 2009, the Treasury Department introduced the HAFA program to provide a viable option for homeowners who are unable to keep their home through the existing Home Affordable Modifica- tion Program (HAMP).

HAFA provides incentives for a bank to work with a homeowner to do a short sale or a deed-in-lieu of foreclosure (DIL), to avoid foreclosing on a loan eligible for modification under the HAMP pro- gram.

Benefits of HAFA:

This program allows the bank to use financial and hardship information already collected for a loan modification to process a short sale.

Homeowners can receive pre-approved short sale terms before listing the home.

This program forces the banks to release the homeowner from future liability for the first mortgage debt (no cash contribution, promissory note, or deficiency judgment is allowed).

A homeowner can get up to $3,000 to cover relocation assistance.